us germany tax treaty interest income

Earnings will be taxed as normal capital income dividends interests capital gains. The treaty has two main goals.

Chapter 7 Residence Based Taxation A History And Current Issues In Corporate Income Taxes Under Pressure

Corporate Capital Gains Tax Rate.

. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Expats might have to pay about 153 of net profit in Self-Employment taxes to the US government. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State.

The tax rate is 25 plus solidarity surplus charge of 55 of the tax total flat rate. Under the Russia-US. Aa income from dividends within the meaning of.

For married couples the filing threshold for joint returns increases to EUR. Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable expenses. 1 Nonresident alien teachers students and trainees who are entitled to treaty exemptions from US.

Most United States tax treaties provide an exemption for certain categories of employees including teachers students and researchers. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt.

And second the treaty helps to promote residents of either country from avoiding taxes. The Federal Republic of Germany and the Italian Republic desiring through a new convention to. B There shall be allowed as a credit against German tax on income subject to the provisions of German tax law regarding credit for foreign tax the United States tax paid in accordance with the law of the United States and with the provisions of this Convention on the following items of income.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. Tax on part or all of their salary for working in the United States are generally required to file. The United States and Germany entered into a bilateral international income tax treaty several years ago.

1 day agoTax Treaties and Exempt Income. Corporate Income Tax Rate. Germany and the United States of America for the Avoidance of Double Taxation and.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Return and a foreign tax credit can then be claimed. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

The purpose of the Germany-USA double taxation treaty The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries. Treaty all interest income is exempt from US. 1954 and amended by the protocol of September 17 1965.

A New Certainty Under The Germany-US Tax Treaty Götz Wiese Stefan Süss Latham Watkins LLP Latham Watkins LLP Law360 New York July 31 2014 1015 AM ET -- In a recent judgment file no. The rate is 49 for interest derived from i loans granted by banks and insurance companies and ii bonds or securities that are regularly and substantially traded on a recognized securities market. Article 11 2 provides a definition of the term interest.

Germany - Tax Treaty Documents. Article 11-----Interest Article 12-----Royalties. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes signed at Bonn on August 29 1989 as amended by the Protocol signed at Berlin on June 1 2006. The German-American tax treaty has been in effect since 1990. First to avoid double taxation of income earned by a citizen or resident of one country in the other country.

Bank account by an American residing in Germany will be taxable in Germany under the USGerman tax treaty. Anyone who earns 400 or more per year from self-employment needs to file a US Tax Return. 7 of the new tax treaty between Germany and the US.

In Germany taxable income is income from employment after the standard deduction and any other deductions are taken. Individual Capital Gains Tax Rate. When it comes to real property income the Germany US Tax Treaty provides that any income generated from the real property situated in one of the contracting states may still be taxed in that state in other words for example if a US person resides in the United States and has an income generated in Germany then Germany can still tax the income even though the person is a.

Progressive rates from 14-45. For example interest earned on a US. Taxation begins at EUR 8004 single individuals.

The income must also be reported on the US. It is based on model income tax treaties developed by the Department of the Treasury and the Organization for Economic Cooperation and Development. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989.

Beyond withholding treatment termination of the treaty would trigger other detrimental consequences such as. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8 of this treaty. 1 CONVENTION BETWEEN THE FEDERAL REPUBLIC OF GERMANY AND THE REPUBLIC OF ITALY FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON INCOME AND ON CAPITAL AND FOR THE PREVENTION OF FISCAL EVASION1.

Agreement Between the United States of America and the Federal Republic of Germany to Improve International Tax Compliance and with respect to the United States. Since Germany has a totalization agreement with the US you can use the treaty benefit to offset US Self-Employment taxes. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

I R 4812 the German Federal Fiscal Court has commented on Art. Signed the OECD multilateral instrument MLI on July 7 2017. The tax treaty serves to benefit citizens and residents from Germany who reside in the United States and vice-versa.

The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income. Over 95 tax treaties.

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Foundation Corporate Tax Revenue Maximizing Rate Jpg Jpeg Image 503 400 Pixels Revenue Corporate Tax Rate Tax

United States Germany Income Tax Treaty Sf Tax Counsel

What Is The U S Germany Income Tax Treaty Becker International Law

Pdf Mexico An Evaluation Of The Main Features Of The Tax System

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

How Do Taxes Affect Income Inequality Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

How Do Taxes Affect Income Inequality Tax Policy Center

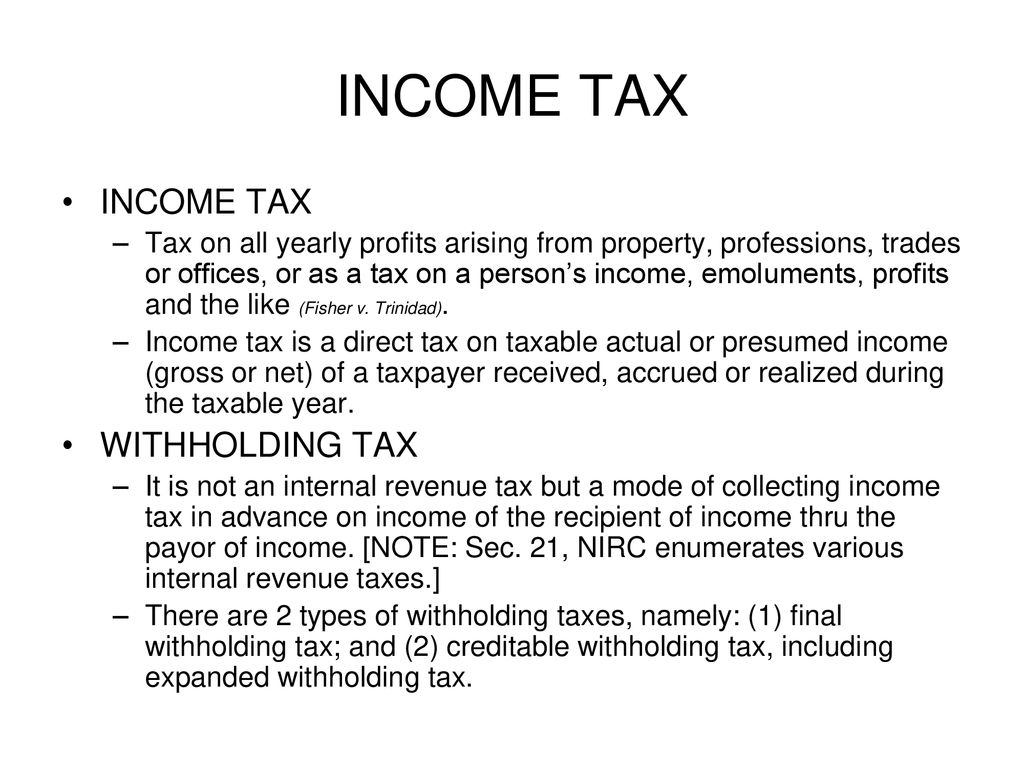

Income And Withholding Taxes Ppt Download

Personal Income Tax An Overview Sciencedirect Topics

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Pdf German Tax System Double Taxation Avoidance Conventions Structure And Developments

Avoiding Double Taxation In Germany A Guide For Uk Expats Expat Focus Filing Taxes Tax Time Tax Season

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China